The ICF Guide to Student Loan Refinancing

Impact Capital Funds’ (ICF) student loan refinancing guide aims to guide a borrower who is considering refinancing student loans. Our intent is to provide a borrower with the tools necessary in order to be better informed, highly organized, and able to make a well-informed personal decision regarding student loan debt refinancing and future financial freedom.

You’ll find what you need right here – from a data worksheet to the terminology used in the industry. You will see questions to ask yourself as you define your goals. Our goal is to help you reach yours, with ease, transparency, and fully informed.

Become Informed

- What? Student loan refinancing allows a borrower to combine federal and private student loans into a new loan with terms that meet one’s needs.

- Why? There are a variety of reasons borrowers choose to refinance their loans:

- Lower interest rate, which saves money.

- Lower monthly payment.

- Different types of interest rates, either fixed or variable.

Know the Terminology

The Student Loan industry has a language that is all its own. To become familiar with vernacular, peruse our dictionary of Student Loan Nomenclature.

Refinancing – What is Your End Goal?

Borrowers hear the term “refinancing” all the time. Determining whether refinancing is the right move requires thought and perhaps, a conversation with a trusted friend, partner, spouse, or family member. Evaluating your personal and financial situation may include the following question:

- What is my purpose for refinancing my student loan(s)?

- Lower interest rate?

- Pay my loan off more quickly?

- Simpler payment?

- Co-signer release?

Follow-up questions, when considering refinancing might consist of:

- What interest rates are being offered for refinancing? Potential lenders – banks, credit unions, as well as companies that specialize in refinancing student loans, offer a wide variety of interest rates, special offers and terms.

- What are my student loan payoff amounts?

- How much can I afford to pay each month?

- Is my credit good enough to refinance my student loans?

- Will I meet the lender’s income requirement?

- Will doing this really help me in the end?

Assembling the Necessary Information

Whether you borrowed for college or graduate school, you have a Master Promissory Note (MPI) issued by the US Department of Education or a private lender. This legally binding contract outlined how and when you would repay your debt. Hold onto this document until you refinance, then you can discard your original MPI and keep the new one.

If you are considering refinancing, you may want to contact your lender and ask for a student loan payoff letter, also known as a “payoff verification statement.” A payoff verification statement provides your payoff amount, your monthly bill obligation, and other important account information. Keep in mind that a payoff letter is only valid for a specific time frame once your loan servicer provides it.

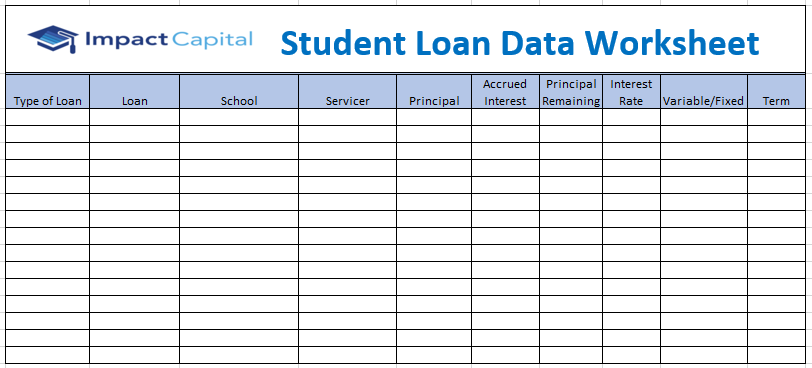

Information Needed

- Type of Loan (Federal or Private)

- Loan Name

- School Attended (when loan was disbursed)

- Loan Service Provider

- Principle Amount

- Interest Rate

- Variable or Fixed Rate

- Loan Ending Date

- Co-signer Name (if applicable)

Using ICF’s Student Loan Data Worksheet (below) can aid you in compiling the necessary information.

Should you be missing any information, contact your lender (private loans) or visit the Department of Education (federal loans) website.

Impact Capital Funds will be offering a calculator to further assist a borrower.

How Refinancing Works

Typically, a borrower can easily refinance student loans online. Upon entering the refinance company’s website and providing basic information, some refinancing companies might provide borrowers the ability to run a soft credit check or pull. In most cases, this does NOT affect your credit score and it is primarily used for screening purposes and to provide you with a range of qualifying interest rates. Most companies have minimum credit score criteria that must be met.

Additional information that might be required:

- Recent pay stubs

- Copy of college or graduate program diploma or transcript

- Proof of residence

- Valid government-issued ID

Refinancing Saves Money

How much money a borrower can save by refinancing student loans depends on several factors:

- The size of the loan

- The current and new refinanced interest rate

- The repayment term

While qualifying for a lower interest rate when refinancing and accepting a shorter repayment period, a borrower’s monthly payment may be higher, but because it will take less time to pay off the loan, savings will be maximized.

Consider this example:

A borrower has $150,000 in student loan debt and is paying it off in 7 years. The total interest is $40,168.00. If the borrower refinances with ICF for 7 years and is offered an interest rate of 3.71%, the total interest would then be $20,550.08. The borrower will save $19,617.94 through the life of the loan by refinancing with Impact Capital Funds.

The saving ramifications are significant. If the borrower was to invest $234.00 per month (the monthly difference of payment when refinancing) for 7 years (84 months) at an 8% average rate of return, the amount saved at the end of that period would be $26,236.

Why Refinance your Student Loans with Impact Capital Funds?

The honest answer – because we are a different kind of company. We realize that the bottom line for a borrower interested in refinancing is this: how can you pay off your student loan debt quickly and with the lowest interest rate. We get that and so do our competitors.

Here’s how we’re different – we are reshaping the student loan refinancing industry. Our investment partners want to know that their dollars are positively changing someone’s life. They could have chosen higher yield instruments, but they choose to invest with us.

Why? Because our unique investment model was designed to simultaneously do three things:

- Deliver modest returns to mission-driven investors

- Issue loans to refinance the high-cost debt of creditworthy graduates

- Generate tuition scholarships at participating universities for students with financial need

Our “difference” in the industry may make all the difference in someone’s life. That’s our goal.

Getting Started

Refinancing makes the most sense for borrowers with good credit, an income to support refinancing a loan, and monthly payments that are affordable and don’t need to be lowered. Begin your journey to the next phase of your life by refinancing with us.

Disclosure: Federal student loans offer several options that are not available when refinancing loans with a private lender: Income-driven repayment plans, Public Service Loan Forgiveness, deferment and forbearance, and discharge of loan due to death or permanent disability.